The OnDeck Score: Making Targeted Small Business Lending Decisions in Real Time

Since 2007, OnDeck has been transforming the way small businesses access capital, using our proprietary technology and small business credit scoring system, the OnDeck Score®, to efficiently evaluate a business’ creditworthiness and make targeted lending decisions in real time. So how do we actually do this? Keep reading to learn more about our OnDeck Score and how it works.

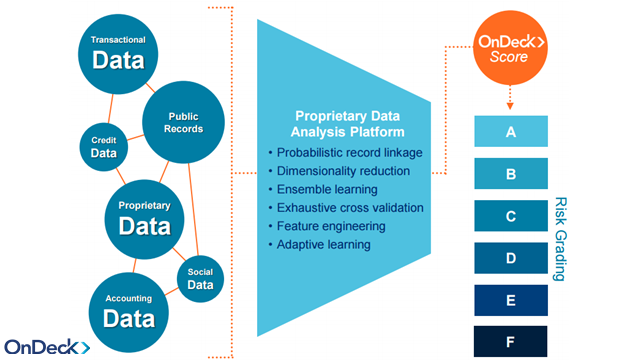

The OnDeck Score is a better alternative to personal credit scores for assessing Main Street’s credit health. Purpose-built for small business, the OnDeck Score looks at more than 2,000 data points to create an accurate business credit profile. These data range from cash flow and transactional data to public records to our own extensive internal historical performance data.

Small businesses are diverse and have complex data footprints, making it difficult for traditional lenders to efficiently underwrite their loan applications. Looking at the distinct cash flow profiles pictured below, it’s easy to see that the loan application for a restaurant will look very different from that of a landscaper or plumber. Without technology or a standardized small business credit score, many traditional lenders rely on manual underwriting and offline document collection (which is onerous and takes too much time) as well as a business owner’s personal BEACON score (which may prove a poor proxy for the health of the underlying business).

The OnDeck Score, our advanced lending technology, and our database of 10 million small businesses enable us to analyze risk and more precisely underwrite businesses across over 700 different industries, including restaurants, landscapers and plumbers. Our approach has been tried and tested in the market since 2007, and we are currently on the fifth generation of our OnDeck Score – with each version more predictive than the last.

Since 2007, OnDeck has delivered more than $11 billion across the United States, Canada, and Australia. We are committed to increasing Main Street’s access to capital and will continue innovating our platform, products and service to meet our customers’ financing needs so they can focus on what’s most important to them – their customers.