Our Meet the Journey Capital Team series introduces you to the passionate individuals behind Journey Capital who are dedicated to helping small businesses succeed.

Go behind the scenes to discover the personal journeys of our team members—from their first steps in the industry to the roles they play today. You’ll hear why they’re committed to supporting small businesses, learn about their most memorable moments, and gain valuable advice straight from the experts.

Get to know the people driving our mission to empower small businesses across Canada.

Natalie Bowmer, VP People & Culture

Q: Can you tell us about your journey in becoming VP of People & Culture at Journey Capital? What led you to this role?

Natalie: My path to this role began with a consulting contract that was originally meant to last just a few months. I saw an opportunity to be part of a smaller, dynamic team in an industry that was entirely new to me—an exciting challenge I was eager to take on.

Before accepting the contract, I had the chance to walk through the office and meet team members, which I deeply respected. People and culture are the heart of any company, and it was clear that Journey Capital prioritized this from the start.

Once I joined, I immersed myself in the business—starting with small projects to build up the HR function, dedicating countless hours to recruiting alongside our team, and truly getting to know our people. Through this hands-on approach, I gained a deep understanding of who we were and what we needed to grow.

When the opportunity arose to transition into a full-time role, I was all in. The team was driven, collaborative, and passionate about supporting SMBs—something that resonated with me. Over time, I built strong relationships that enabled me to implement new structures, tools, and systems to support both our employees and the organization as a whole.

I’m someone who never gives up. I’m adaptable, solution-oriented, and always thinking ahead—but with the reality of a growing company in mind. I wanted to do more than just support the operational side of the business; I wanted to help shape its strategic direction. I leaned in to help define our company’s goals and culture, recently leading our team through a rebrand from a people and values perspective.

My biggest lesson? Never give up. Work hard, work smart, and surround yourself with great people. Keep learning—through courses, seminars, leadership groups, reading, and being challenged by others. Be the one to ask questions, explore new ideas, and adjust your approach when needed. Talk less, act more, and always align your actions with the bigger picture.

Q: What does “People & Culture” mean to you, and how do you bring it to life?

Natalie: People & Culture is the human side of our business. It’s the diverse backgrounds, perspectives, and talents that shape who we are and why we exist: to help Canadian small business owners. It’s reflected in how we treat one another, our customers, and our partners. Culture comes to life through our actions, grounded in our values.

We don’t just talk about our values—we live them. Whether it’s being transparent with customers on pricing, taking ownership of our work, approaching challenges with balance, or finding new ways to innovate, our culture is built on everyday behaviours that define our team.

We foster this culture through recognition and engagement. Our Slack shoutout channel allows colleagues to highlight how they see our values in action—whether it’s challenging the status quo, supporting a teammate, or working extra hard to complete a project that will benefit the company as a whole.

Our annual recognition award ceremony further celebrates those who go above and beyond to embody our culture. But culture isn’t static; it evolves. That’s why we regularly take the pulse of our people, listen, and adapt to ensure our workplace remains one where everyone can thrive.

Q: How do you foster a positive and inclusive workplace culture, especially in a fast-paced company like Journey Capital?

Natalie: Fostering a positive and inclusive workplace starts with open communication from day one. We actively listen, encourage diverse perspectives, and demonstrate inclusive behaviors to ensure everyone feels heard and valued. Success here isn’t just about working with like-minded people—it’s about collaborating with those who challenge your thinking and bring fresh ideas to the table.

We’ve built a culture of sharing knowledge and learning from one another through roundtables, daily stand-ups, and all-hands meetings. These spaces allow team members to share updates, showcase projects, gather feedback, ask questions, and openly discuss ideas. By creating these opportunities, we ensure that every voice matters, and together, we continue to evolve.

Q: What are some of the biggest challenges businesses face when it comes to talent management, and how do you help overcome them?

Natalie: We know that attracting and retaining top talent isn’t just about offering a job; it’s about creating an environment where people feel supported, valued, and empowered to grow. Here’s how we’re tackling some of the biggest talent management challenges and ensuring our team thrives:

- Balancing remote and in-office collaboration:

The way we work has fundamentally changed, and flexibility is key. We’ve. introduced Anchor Days, dedicated in-office days throughout the month, to keep our team connected while maintaining the benefits of remote work. This ensures that when we come together, it’s both meaningful and productive. - Work from anywhere, not just home:

We recognize that remote work means different things to different people. That’s why our work-from-anywhere policy gives employees the freedom to choose where they work best—whether that’s at home, a co-working space, or even while traveling. This level of flexibility helps support our team’s diverse needs while ensuring they stay engaged and productive. - Investing in growth and development:

As a smaller company, we prioritize continuous learning to give our team every opportunity to expand their skills:

- $1,500 per employee for external training.

- Free language classes to support professional and personal growth.

- A leadership development program designed to help our managers become strong, people-focused leaders.

- A new learning tool launching in 2025 that will enable employees to share knowledge, explore topics beyond their roles, and take ownership of their learning journey.

We don’t just want to talk about career development, we make it happen. By empowering our people with the flexibility, tools, and learning opportunities they need, we’re creating an environment for them to lean in and own their growth.

Q: Employee engagement is key to a thriving company. What strategies do you use to keep the Journey Capital team motivated and connected?

Natalie: We believe that engagement isn’t driven by a single initiative. It’s the cumulative effect of many small, intentional actions that create a culture where people feel valued, connected, and motivated.

It starts with the people we hire. Bringing in the right talent ensures that our team is surrounded by individuals who share our values and contribute to a strong, collaborative culture. From there, we make it a priority to celebrate milestones, whether it’s welcoming new hires, recognizing achievements, or celebrating our team’s special life events.

We also foster connection through monthly company-wide activities that focus on social engagement and well-being. These events bring teams together outside of their day-to-day work, strengthening relationships across departments. In addition, we host industry speakers to keep our team informed on emerging trends, reinforcing a culture of continuous learning.

Regular one-on-one check-ins are embedded into our culture, ensuring that every team member has dedicated time with their leader to discuss growth, challenges, and feedback. We complement this with company-wide all-hands meetings and two large annual events where employees from across Canada come together. These gatherings kick off with a team-building activity, followed by great food and a couple of drinks to cap off the night—because celebrating together is just as important as working together.

Our approach is simple: we prioritize people and connection. It’s this combination that keeps our team engaged and thriving.

Q: What advice would you give to small business owners looking to build a strong and resilient team?

Natalie: Building a strong and resilient team starts with the people you bring in. Hire individuals who are not only skilled but also coachable, honest, and willing to treat the company as their own. As a business owner, you already know your business inside and out. Your role is to share that knowledge, inspire your team, and create an environment where they feel valued and empowered.

Look for people who challenge you in the best way, those who bring fresh perspectives, push boundaries, and help you grow as a leader. A strong team isn’t built on compliance; it’s built on trust, shared purpose, and the willingness to navigate challenges together.

The right people, when given the right culture, will take ownership, step up when it matters, and help shape the future of your business. Trust your instincts, invest in your people, and everything else will fall into place.

Q: In your experience, how has workplace culture evolved over the years, and what trends do you see shaping the future of work?

Natalie: Workplace culture has evolved from the traditional 9-5 model to a focus on results, allowing people to work from anywhere. New technologies like AI and machine learning continue to reshape how we work, while employee experiences have shifted from a one-size-fits-all approach to more flexible, personalized options.

The way people want to work is also changing—there’s a growing preference for consulting and freelance roles over full-time positions, giving workers more control over their schedules. Companies are adapting by hiring for specific skill sets on a contract, part-time, or freelance basis, embracing the gig economy. As long as teams remain open, flexible, and supported, these changes will be positive. Culture will continue to evolve, and so will we.

Q: What’s one leadership lesson that has stuck with you throughout your career?

Natalie: One leadership lesson that has always stuck with me is the power of honesty and authenticity. If you don’t have an answer, it’s okay to admit it—but what truly matters is following up with the right information and a well-thought-out action plan that can be discussed.

Leadership isn’t about having all the answers; it’s about being accountable, learning continuously, and ensuring your team knows they can trust you to figure things out.

Q: Outside of work, what do you enjoy doing to recharge and stay inspired?

Natalie: Outside of work, life is just as busy—but in the best way! As a mom of two, you’ll often find me at the hockey rink cheering on my boys. I love the energy and sense of community that comes with it. When I’m not at the rink, I recharge by getting my hands in the dirt, gardening, hitting a workout, or simply surrounding myself with friends and family.

Nicoleta Borodulin, Risk Control & Credit Analyst

Q: Welcome to the team! You’ve been with Journey Capital for six months—how has your experience been so far?

Nicoleta: It has been a great experience so far! The team was very welcoming and supportive, which made it easy to settle in. I had the opportunity to deepen my understanding of both fintech and funding mechanisms and was able to apply my skills quickly to contribute to the company.

Q: What drew you to the Risk Control & Credit Analysis team?

Nicoleta: I was drawn to this team because I enjoy using my analytical skills to assess risks and help make informed decisions. I also understand the importance of risk mitigation and I find it fulfilling to know our work plays an important role in helping small businesses thrive.

Q: Can you describe your role and how it helps support small businesses?

Nicoleta: In my role, I assess potential risks, help identify and create a clear picture of the company’s cash flow, and ensure all documentation aligns with the funding requirements. This process not only helps protect the company but also ensures small businesses receive the necessary funding and support in order to succeed.

Q: What do you enjoy most about working at Journey Capital?

Nicoleta: I really enjoy the collaborative and supportive team environment where everyone is focused on achieving common goals. The role also provides a mix of analytical challenges and the opportunity to make a real impact, which keeps me both engaged and motivated!

Q: Risk assessment is a big part of your job—what skills are essential for success in this field?

Nicoleta: Risk assessment requires attention to detail and the ability to think critically about potential outcomes. It’s important to be able to identify any patterns or spot potential risks before they become issues. Strong communication skills are also essential as you need to present your findings clearly to others.

Q: What’s been the most interesting or rewarding challenge you’ve tackled so far?

Nicoleta: One of the most rewarding challenges has been evaluating businesses in industries that I hadn’t previously worked with. Each industry has its own unique risks and understanding these nuances has been both interesting and rewarding.

Q: If you could give one piece of financial advice to small business owners, what would it be?

Nicoleta: My advice would be to focus on building and maintaining strong credit. Having a solid credit history opens doors to better funding opportunities and makes it easier to overcome financial challenges. Moreover, it’s important to manage debt responsibly and build a good relationship with lenders as this provides your business with the financial flexibility it needs to grow.

Q: Tell us a fun fact about yourself—any hobbies or interests outside of work?

Nicoleta: Outside of work, I’m passionate about art and love creating it during my free time. I also enjoy reading, traveling, and experimenting with new recipes in the kitchen.

Q: Looking ahead, what are you most excited to learn or achieve in your role?

Nicoleta: I’m excited to continue to develop my skills in risk management and learn more about how emerging fintech trends might impact funding in the future. I’m also looking forward to taking on new challenges that will allow me to contribute to the company’s long-term goals and continue to help small businesses reach their full potential.

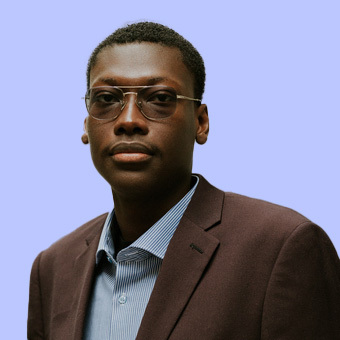

Aboubakr Ndiaye, Business Development Representative

Q: Can you share a bit about your journey to becoming an Account Executive at Journey Capital?

Aboubakr: My journey started more than a year ago in the renewal sales team. I had just graduated from school eager to start my career in a dynamic environment. I wanted a role where I could learn and grow, and becoming an Account Executive was the perfect opportunity to do just that.

Q: What do you enjoy most about working with small businesses and helping them secure financing?

Aboubakr: I enjoy working with small businesses because they are often the manifestation of people’s dreams and hopes. Helping them secure the financing they need is a way of supporting them in achieving their goals and turning those dreams into reality.

Q: What is the most rewarding part of your role as an Account Executive?

Aboubakr: The most rewarding part of my role as an Account Executive is seeing our client portfolio grow, knowing that we are helping many people achieve their goals through the services and financing we provide.

Q: What advice would you give small business owners who are looking to finance their next big project?

Aboubakr: I would say understand your cash flow and be patient, consider working with a trusted financial partner who can guide you through the process. It’s important to choose the right financing option that aligns with your business goals.

Q: Can you describe a memorable experience where you helped a client overcome a challenge?

Aboubakr: I assisted a restaurant owner in consolidating his loans as the multiple payments were really affecting his cashflow and he didn’t have much breathing room. He always reminds me of how we helped him and offers me to come eat at his restaurant for free.

Q: What do you think sets Journey Capital apart in the online lending industry?

Aboubakr: What sets Journey Capital apart is our focus on aligning with the merchant’s goals first. We prioritize understanding their needs and provide real solutions to their problems, ensuring they get the support they need to succeed.

Q: What keeps you motivated and passionate about your work every day?

Aboubakr: The opportunity to learn as much as possible in a dynamic environment and to get better every day.

Pavina Trichanh, Sales Manager

Q: Tell us a little bit about your path to Journey Capital. What inspired you to help small businesses?

Pavina: My journey began over a decade ago as a Customer Service and Operations Representative. Upon learning about the high interest rates charged by other lenders, I felt compelled to educate our clients and ensure they were well-informed. Recognizing my dedication, the company promoted me to an Account Manager role, where I successfully helped thousands of clients reduce costs. Today, I lead the Renewal Team, guiding them to continue this mission.

Q: What’s the most rewarding part of your job as an Sales Manager?

Pavina: The most rewarding part of my job is hearing a client choose to stay with us, trusting in my guidance, and saving thousands of dollars without any hidden fees.

Q: Can you share a memorable client story that highlights the impact Journey Capital has on small businesses?

Pavina: I assisted a small business owner who ran a cycling company by consolidating her business loans. She was so pleased with the improvement in her cash flow that she sent me a handmade knit scarf. I still have it to this day; it was the cutest gesture!

Q: What’s the biggest challenge you see small businesses face, and how do you help them overcome it?

Pavina: The biggest challenge I often see is managing business cash flow. Many businesses take on loans from multiple lenders with high interest rates and short terms, leading to non-sufficient funds (NSF) and decreased financial stability. Additionally, since COVID-19, delays in shipments have further exacerbated these struggles. We help businesses understand their cash flow and work to consolidate their loans into smaller payments with lower rates, ultimately improving their cash flow.

Q: What advice do you have for entrepreneurs who are just starting out?

Pavina: Manage your cash flow wisely. Avoid high-interest loans with short terms, as they can lead to financial instability. Since COVID-19, shipment delays have added to these challenges. We help businesses by consolidating loans into smaller payments with lower rates to improve cash flow

Q: When you’re not helping businesses reach their goals, how do you spend your free time?

Pavina: In my free time, I like to learn more about how we can assist businesses in the future.

Q: Finally, what’s one thing you’d want every small business owner in Canada to know?

Pavina: I’d want every small business owner in Canada to know that leveraging digital tools and online marketing can significantly boost their reach and efficiency. Embracing technology can open up new opportunities and help them stay competitive.