Category: Uncategorized

3 Business Jokes for Your Friday

Almost done with the work week? Here are a few jokes to get you through those last remaining hours. JOB APPLICANTS: Murphy and Jill applied for the same engineering position at a New York firm. Both applicants, having the same qualifications, were asked by the manager to take a test. Upon completion of the test…

What Is Peer-to-Peer Lending?

There are numerous ways that small business owners can get financing for their business, and peer-to-peer lending is one option. What is peer-to-peer lending? Peer-to-peer lending is one way to obtain small business financing. It refers to businesses that turn to other consumers and organizations – as opposed to verified lenders – in order to…

Totally Crazy Tax Rebates

You may think the tax deductions below are April Fools’ Day jokes, but they all somehow made their way to the Internal Revenue Service – and all of them were approved! 1. Pet Food According to Fox Business, the IRS allowed one family to deduct the cost of cat food from their tax payments. The…

What is a business equipment lease?

Every week, we seek to arm small businesses owners with the right tools to make informative financing decisions. In previous posts, we’ve covered merchant cash advances, business lines of credit and SBA loans. Today, we are going to explore business equipment leases – a form of financing 80% of businesses use to lease equipment, according…

Don’t Procrastinate! File Your Tax Extension Today

Even if you have the best intentions in mind, as a small business owner it’s easy to fall behind when it comes to filing your taxes. Working around-the-clock – answering calls, entering meetings, tending to customers and employees – leaves little time for assembling your tax documents or even finding a CPA. If you need…

Small Business Lessons: Laurie Pehar Borsh PR

The Problem: A seasoned public relations executive, Laurie Pehar Borsh has owned her own agency for over 20 years. After landing a huge client in March of 2013, she needed financing to take on a new employee and purchase office equipment. Even though she had a profitable business, the bank wouldn’t lend to her because…

What is a Small Business Administration loan?

Our Hump-day Help section is designed to provide business owners useful information about the different types of financing available. We’ve answered your questions about business lines of credit and merchant cash advances. Today, we are going to explore SBA loans. You can also visit OnDeck’s SBA comparison page here. What is a Small Business Administration…

How to Find a Certified Public Accountant for Your Small Business

Last week we discussed three practices to keep in mind during the 2014 tax season. Our number one tip was to let a professional handle your taxes, but perhaps you are now wondering how to find the right accountant for your business. We put together some important tips to help you select the best CPA…

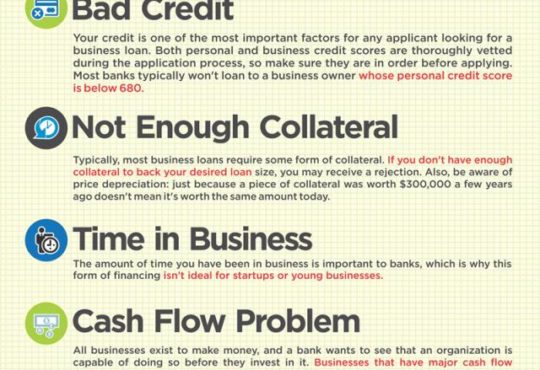

5 Reasons Your Bank Loan Application May Have Been Denied

For many business owners, applying for a traditional bank loan can be a daunting undertaking. After spending weeks assembling paperwork, many small business owners are often left scratching their heads upon receiving a rejection. In order to make the most of your time, avoid these five common bank loan application mistakes from loans.org: If your…

OnDeck Crosses the $1 Billion Mark

Today, the OnDeck Team officially crossed the $1 billion mark in total capital delivered to Main Street. It’s been an incredible journey thus far, and we’ve only just begun. OnDeck is a Google Ventures-backed company with an A+ Rating with the Better Business Bureau. The company offers small business loans nationwide to over 725 different…

Small Business Lessons: Social Media Round Up

This week, we’ve been receiving an outpouring of incredible testimonials from our small business customers through social media, including Twitter, Facebook and Yelp. Below are a few choice examples: To see what else small business owners are saying about OnDeck, click here. OnDeck is a Google Ventures-backed company with an A+ Rating with the Better…

Top 3 Tips for Small Business Owners this Tax Season

There’s nothing that small business owners look forward to less than tax season. To help get you in tax-mode, we’ve outlined the top three best practices for small business owners. By keeping these tips in mind, your 2014 tax season should be less stressful: 1. Let a Professional Handle Your Statements Leave the complicated stuff…

FitSmallBusiness.com Ranks the Best Small Business Loan Providers

According to FitSmallBusiness.com, OnDeck is the best provider of short term small business loans. FitSmallBusiness.com recently published an article comparing OnDeck, PayPal and Kabbage. The report crowned OnDeck as “the best short term loan provider to small businesses,” noting our financing is ideal for brick-and-mortar businesses that often are unable to access traditional bank financing.…

OnDeck’s CEO Noah Breslow Appears on CNBC Squawk Box

On the heels of our recent funding announcement – a $77 million growth round led by Tiger Global Management – CEO Noah Breslow sat down with CNBC Squawk Box to discuss how OnDeck is disrupting the small business lending industry. As noted in our press release and the interview above, OnDeck is expecting to reach…

OnDeck Main Street Tour: Denver, Colorado

Following our success in Tampa, Washington DC, Chicago and Minneapolis, COO James Hobson headed to Denver to continue the OnDeck Main Street Tour tradition of visiting with real customers to get unfiltered feedback. We started the day with Tom Schumacher, who opened Hot Cakes Diner in Denver nearly 12 years ago. After growing his business…