Category: Canada

Building a business for Generation Z

With most of Generation Z now in their late teens and early twenties, a new wave of consumers, employees and proprietors is emerging. According to a survey from RBC, challenging economic conditions have strengthened the desire for entrepreneurship in Canada, especially among younger people. Known as a tech-savvy generation, Gen Zers are leading the way…

Recession-proof your small business

Is Canada currently in a recession? Although some small businesses have seen a pullback in sales, technically speaking, we aren’t in a recession just yet. And in most cases, we don’t know we’re in a recession until it’s over. A new study from RBC suggest that a recession is almost inevitable, and we could see…

Black Friday for small businesses – Should you care?

Holiday sales events like Black Friday and Cyber Monday are incredibly important for all businesses across Canada. But, let’s not forget about Small Business (November 26), which is conveniently nestled between both and was created with SMBs in mind. Every year, Canadians gear up for these peak days of shopping on and offline. We’re here…

OnDeck Canada closes $75M senior credit facility with Bank of Montreal and Equitable Bank

OnDeck Canada, a leading fintech player in the small business lending space, today announced that it has expanded its senior credit facility to $75 million. The senior credit facility was arranged by Bank of Montreal (“BMO”), the company’s senior lender since 2017, and now includes Equitable Bank. Since its founding in 2008, OnDeck Canada has…

Small Business Week: Tell us your story

Small Business Week is finally here! Although it’s a great opportunity for education and networking, more importantly, it’s a time of celebration. This year, we’re taking the opportunity to celebrate Small Business Week by highlighting some of our favorite small business success stories. Hear from six small business owners who started their businesses from scratch…

Small Business Week: How to get involved

Small Business Week is right around the corner, but what does this mean for Canadian small business owners? For the past 43 years, BDC has organized an annual celebration of small businesses where entrepreneurs gather to learn, network and celebrate what it means to be a small business owner in Canada. From October 16th to…

Update: How rising rates impact your SMB

The current high interest rate environment is taking a toll on both consumers and small businesses alike. In March of 2020, borrowing rates in Canada were lowered to nearly zero and despite Covid restrictions, low-cost money starting flowing into SMBs. Fast forward two years later, inflation reached a 39-year high of 8.1% in June of 2022. To…

Canadian small businesses in 2022: Facts and trends

Canadians love small businesses – and with good reason. The numbers speak for themselves, as of late 2021, about 98.1% of Canadian businesses were considered small (i.e., fewer than 100 employees). They employed 10.3 million individuals in total, accounting for 63.8% of the Canadian labor force, and produced over 40% of the total value of…

Assessing the financial health of your SMB

With talks of a recession on the horizon, is your small business in a position to succeed regardless of what the future has in store? Understanding and monitoring the current state of your business’s financial health is key to navigating an economic downturn. But when it comes to assessing your financial health, the influx of…

Creating a healthy workplace for your small business

The success of any business depends on the strength of its employees. That’s why creating a healthy workplace is something that every small business owner should strive for. As many employees experienced more flexible working arrangements due to the pandemic, they now expect more than just a paycheck. They want an employer that cares about…

The Metaverse and its impact on small businesses

The Metaverse. As a small business owner, does this term stir curiosity, confusion, or even fear? Maybe you’re wondering if the Metaverse is the future of the Internet, and if your small business can benefit from it? Is the Metaverse already here? While there has been a lot of buzz around it, it’s still very…

How to improve your customer communication

Customer communication always has, and always will be, a critical and difficult skill for small businesses to master. It comes with no surprise that 89% of consumers consider customer service as the driving factor for repeat business. The consumer of today doesn’t tolerate lackluster communication and expects businesses to be accessible and available – always.…

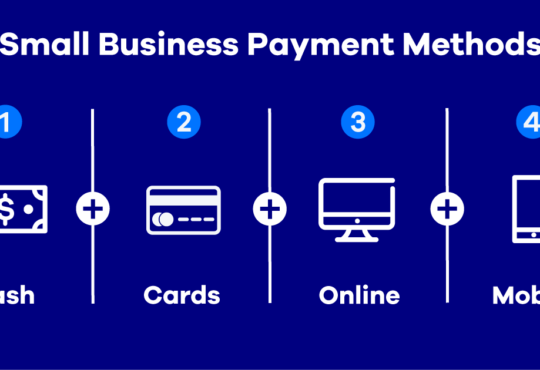

SMB payment methods to boost sales

Throughout the past decade, the different payment methods in which customers have been able to use with their favorite small businesses have evolved at an unprecedented pace. As a small business owner, it can be a complicated and costly experience to keep up with all changes happening in the world of payment solutions. This especially…

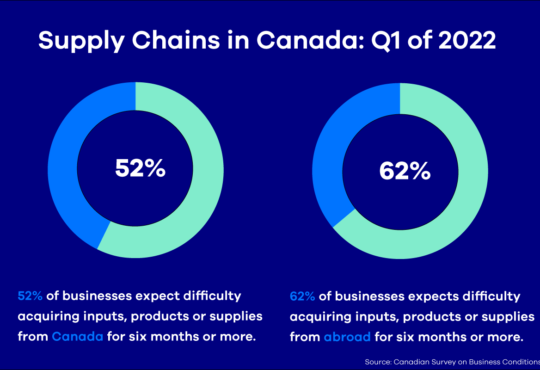

Building a resilient SMB supply chain

Supply chain issues continue to haunt small business owners well into 2022. These issues materialized during the onset of the pandemic and were further exacerbated by the recent war in Ukraine. While it may seem that only larger companies are affected, supply chain disruptions impact small businesses just as much. In a recent survey, up…

How rising rates impact your SMB

Since March of 2020, borrowing rates in Canada have been historically low and low-cost money has been flowing into small businesses. With record-high inflation knocking at our door, the Bank of Canada announced a series of incremental rate hikes to wrestle inflation under control. Rates will likely continue to climb even further as inflation remains…