Category: Business Financing

Flex Funds Advance – everything you need to know

Ask any business owner what their top requirement for success is, and they will tell you: flexible financing. Traditional lending options, like loan and line of credit, have their place but can fail to address the unique needs of certain types of businesses. This is why we created Flex Funds Advance. With a variable repayment…

Is a Business Line of Credit right for you?

Unlocking the potential of a Business Line of Credit for your small business goes beyond understanding its basic definition. While many business owners are familiar with the concept, they may not fully grasp the specific scenarios in which a Business Line of Credit can be beneficial. In this blog post, we’ll share the benefits a…

Should you incorporate your small business?

It’s the age-old question for small business owners: to incorporate or not to incorporate? Incorporation may have seemed like a distant dream when you started your business, but as your business grows and evolves, you may find yourself considering this option more seriously. It can be tempting to put off this decision, but the truth…

Top trends affecting SMBs in 2023 – Part 1

Over the past few years, small businesses have faced an enormous set of challenges, undergone an incredible amount of change, and have had to practice adaptability to new emerging trends. Unfortunately, there’s no reason to believe this will subside anytime soon, as the Canadian economy is set to face a mild recession. Still, small and…

Valentine’s Day: A Holiday for SMBs

While it has evolved over the years, Valentine’s Day still holds a special place in hearts across the globe. For small businesses, it’s mostly seen as a great opportunity to boost sales. In fact, over the last 5 years, Canadians spent an estimated 3 billion dollars on February 14th. Whether it’s through creative marketing campaigns,…

Understanding personal & business credit

When it comes to managing your finances, understanding the difference between personal and business credit can help you make informed decisions about your business and ensure that you are making the best use of your resources. Good personal and business credit scores are vital for any small business owner to access the financing they need.…

A small business guide to podcasts

It seems like everyone is starting their own podcast these days. They’ve gone from a niche market to mainstream in only a matter of years – and with good reason. As of January 2023, there are over 5 million podcasts with over 70 million episodes between them. Canadians are giant consumers of podcasts, with more…

Leveraging artificial intelligence for your SMB

Unless you’ve been living in a cave, you’ve probably heard about the newest Artificial Intelligence viral sensation, ChatGPT. Created by a company called OpenAI, this software was designed to generate humanlike responses to a wide range of questions. Unlike humans, ChatGPT has all the world’s knowledge. It can write essays, poems, scripts, or even translate…

Small business checklist – Planning for 2023

For most small business owners, this time of the year is dedicated to getting ready for the Holiday rush and ending things on a strong note. However, it’s important to plan for what’s to come. After all, 2023 is just a few weeks away. Having a small business checklist at your disposal gives you a…

Building a business for Generation Z

With most of Generation Z now in their late teens and early twenties, a new wave of consumers, employees and proprietors is emerging. According to a survey from RBC, challenging economic conditions have strengthened the desire for entrepreneurship in Canada, especially among younger people. Known as a tech-savvy generation, Gen Zers are leading the way…

Small Business Week: How to get involved

Small Business Week is right around the corner, but what does this mean for Canadian small business owners? For the past 43 years, BDC has organized an annual celebration of small businesses where entrepreneurs gather to learn, network and celebrate what it means to be a small business owner in Canada. From October 16th to…

Update: How rising rates impact your SMB

The current high interest rate environment is taking a toll on both consumers and small businesses alike. In March of 2020, borrowing rates in Canada were lowered to nearly zero and despite Covid restrictions, low-cost money starting flowing into SMBs. Fast forward two years later, inflation reached a 39-year high of 8.1% in June of 2022. To…

Canadian small businesses in 2022: Facts and trends

Canadians love small businesses – and with good reason. The numbers speak for themselves, as of late 2021, about 98.1% of Canadian businesses were considered small (i.e., fewer than 100 employees). They employed 10.3 million individuals in total, accounting for 63.8% of the Canadian labor force, and produced over 40% of the total value of…

Assessing the financial health of your SMB

With talks of a recession on the horizon, is your small business in a position to succeed regardless of what the future has in store? Understanding and monitoring the current state of your business’s financial health is key to navigating an economic downturn. But when it comes to assessing your financial health, the influx of…

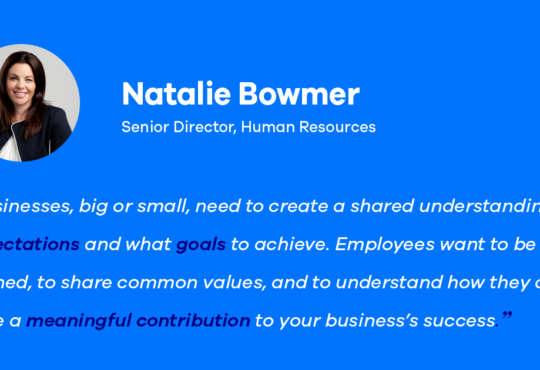

Creating a healthy workplace for your small business

The success of any business depends on the strength of its employees. That’s why creating a healthy workplace is something that every small business owner should strive for. As many employees experienced more flexible working arrangements due to the pandemic, they now expect more than just a paycheck. They want an employer that cares about…