Category: Business Financing

Small Business Lending: Are You Ready for a Loan?

I have a consultant friend who helps struggling Main Street businesses get back on their feet. Yesterday he and I were talking about the current state of small business in general and all the changes that have impacted how small business owners find the capital they need to keep their business thriving. As you might…

5 Common Startup Financing Mistakes

Financing a startup is a challenge. In fact, unless you have exceptional credit and some cash in the bank it can be almost impossible. Writing for SmallBusinessTrends.com, Tom Gazaway identifies five common mistakes that make it even a harder—yet are pretty easy to overcome with a little bit of planning and forethought. Gazaway suggests you…

Small Business Lending: Does Your Business Qualify for an SBA Loan?

Although the SBA (Small Business Administration) is not a bank and doesn’t actually make small business loans, they do offer a guarantee to the traditional lenders, like banks and credit unions, which do. The SBA might not be the biggest source of funds available to small business owners, but they are an important source—making funds…

Ask These 4 Questions to Find the Right Loan for Your Small Business

When most people think of a small business loan, they think of a term loan at the bank—but there are dozens of other options available to small business owners today. Finding the right loan isn’t as simple as going into the bank anymore. Asking yourself the following four questions will help you find the right…

Enter the Loan Process Educated About Small Business Financing

The time to investigate small business financing is before you need it. The last few years have seen big changes in the world of small business financing. Because of those changes, most small business owners don’t know what they don’t know—it’s changed that fast. Although I believe anything that gives greater access to capital has…

7 Awesome Facts about Veteran Small Business Owners

In honor of Veteran’s Day, OnDeck is celebrating veterans small business owners all month long. Here are seven awesome facts about veteran small business owners: 1. Extremely Motivated According to the SBA, veterans are roughly 45% more likely to form their own business compared to people who haven’t served any time in the military. 2.…

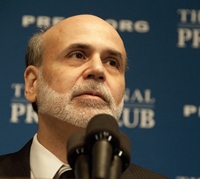

If Bernanke Can’t Refinance, Are Credit Standards Too Tight?

We all know getting a small business loan can be tricky given the current state of the economy and lending standards, but it looks like Main Street isn’t alone. One doesn’t have to look any farther than former Federal Reserve Chairman Ben Bernanke to see the impact of more stringent regulation. The former Fed leader…

This Motivated Senator Wants to Fix the Small Business Loan Gender Gap

Recent studies have shown that woman business owners have a much tougher time obtaining small business financing than their male counterparts…and one motivated Senator is on the job and fighting for change. Maria Cantwell is the chairwoman of the Senate Committee on Small Business and Entrepreneurship, and she’s made closing this particular “gender gap” a…

1 Essential Tip for Becoming a Better Borrower

We’ve often spoken about the factors that can help you and your business look more attractive to lenders – like having a strong business credit profile. While important, there’s one major factor lenders look at that requires greater attention: cash flow. James Good, of the Small Business Payments Company, explained to Forbes recently that small…

3 Essential Documents Your Business Needs at the Ready

One of the most important – albeit less thrilling – responsibilities business owners need to pay attention to is their paperwork. Although essential when it comes time to pay your taxes in the spring, having your key documents organized and ready is crucial for when you want to access financing. According to The U.S. Small…

3 Insanely Easy Ways to Improve Your Business Credit Score

We’ve detailed numerous ways business owners can boost their credit scores – including “5-3-2 Rule” and credit blunders to avoid. But what you’re looking for some easier fixes? Don’t fret – here are three easy ways to give your score a boost. But what you’re looking for some easier fixes? 1. Break your payments up…

Business Financing Through Unconventional Methods

For those small business owners that think a small business loan is out of their reach – prepare to be inspired. Jake Fitzsimmons, opened a hamburger bar in Colorado in 2010. He thought the odds of obtaining a loan were so low that he often asked himself, “why even bother [applying]?” However, because he had…

How the Gender Gap Affects Small Business Loan Approvals

If you’re looking to get a small business loan, there are many factors that come into play. Your credit history, your business’ cash flow and numerous other things will be looked at by lenders. However, there’s another factor that seems to be coming into play: gender. According to recent reports, female small business owners are…

The 3 Fastest Growing Small Business Industries

Across the country, there are a number of industries that are beginning to bustle with activity as more small businesses get in on the action. And if you’re looking for a tip on what these growing industries may be, then Inc. Magazine has you covered. The news outlet recently specified some of the fastest growing…

How to Meet the SBA’s loan criteria

To be eligible for a loan from a U.S. Small Business Administration-approved lender, you need to meet a lot of standardized criteria – all of them listed on the SBA’s website. However, you’ll need to do more than just meet the bare minimums, no matter what lender you’re applying to. Listed below are four tips…