Category: Blog

Summer marketing strategies for SMBs

Summer is almost here, but now is not the time to take a vacation from marketing. Depending on your industry, you might see sales ramp up or slow down during the summer. Either way, you don’t want to stand still while your competitors get ahead of the curve. Summer marketing can be different in many…

Building a resilient SMB supply chain

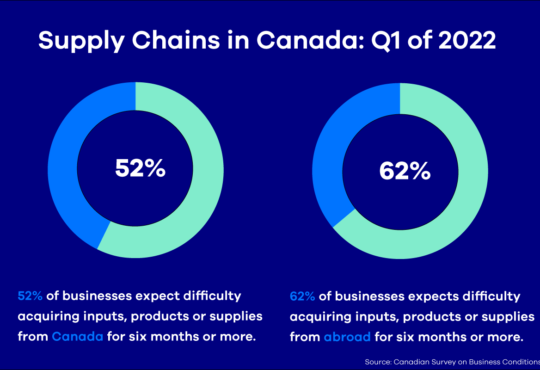

Supply chain issues continue to haunt small business owners well into 2022. These issues materialized during the onset of the pandemic and were further exacerbated by the recent war in Ukraine. While it may seem that only larger companies are affected, supply chain disruptions impact small businesses just as much. In a recent survey, up…

How rising rates impact your SMB

Since March of 2020, borrowing rates in Canada have been historically low and low-cost money has been flowing into small businesses. With record-high inflation knocking at our door, the Bank of Canada announced a series of incremental rate hikes to wrestle inflation under control. Rates will likely continue to climb even further as inflation remains…

CDAP – Canada Digital Adoption Program

The Canada Digital Adoption Program (CDAP) For small business owners, cost has always been a limiting factor in adopting new technology. Let’s face it, it’s expensive and can be a challenge to identify which tools and strategies will benefit your business in the long run. Luckily, the Government of Canada is implementing The Canada Digital…

Small business leadership traits to master

For any business endeavor to succeed, you need a solid leader who possesses a specific set of traits. In larger corporations, leadership has always been a highly discussed and celebrated topic. But what about leadership in small businesses? SMB owners are typically thrown into the fire as leaders and expected to adapt quickly. With your…

Recruiting tips for Canadian SMB owners

In February, the economy added 336,600 new jobs (2/3 being part-time jobs) and the jobless rate fell to 5.5%, reaching pre-pandemic levels. Employment in Canada is gaining momentum and with your business quickly regaining traction due to Covid-19 restrictions being lifted, things are looking promising! But there’s one problem. You need to hire new staff…

Tax season 2022: A guide for Canadian SMB owners

Tax season is officially here. If you’re new to the Canadian small business environment, you may be unfamiliar with the tax laws that apply to small businesses and self-employed individuals. Just like employment income, income from your small business is subject to taxation. In Canada, small businesses and self-employed income can be defined in many…

Optimize your SMB for a post-pandemic world

With some countries already removing Covid-19 restrictions entirely and talks of learning to live with the virus, small business owners are now wondering how they can optimize their business to succeed in an eventual post-pandemic world. It comes with no surprise; small businesses were affected by the pandemic and experienced an unprecedented pace of change.…

What cybersecurity means for SMBs

The Covid 19 pandemic has brought on several changes in the way SMBs do business. More and more, we’re seeing Canadian SMBs embracing digital tools and technologies to better serve their customers. In fact, a new study from PayPal Canada shows that 47% of Canadian small businesses started selling online in 2020. While digital transformation…

SMB strategies to manage inflation

With ongoing supply chain issues and the Omicron variant taking our country by storm, a lot of uncertainty remains for 2022. One major uncertainty is inflation. Much of the current inflation is due to significant imbalances between supply and demand for goods and services. In 2021, we saw a surge in consumer demand and a…

SMB hacks for improving cash flow

Managing cash flow. As an SMB owner, those three words may seem daunting at first, and we don’t blame you. Research shows 64% of Canadian small business owners are burdened with cash flow issues. If you can efficiently manage your cash flow, you will have much more available capital to play with. This comes with…

How to make your SMB sustainable

More and more, we’re seeing small business owners and entrepreneurs wanting to contribute to a sustainable economy. Small business owners and their employees are now in a position to make a difference and to seize this opportunity to build and grow an economy that’s sustainable. By doing so, they will cater to a larger audience,…

Content to enrich your SMB’s social media

Where do I Start? Social media is continually changing the way that we communicate and consume information. Today, quality content is the foundation and at the heart of any successful social media strategy. As a small-business owner, it can be challenging to dedicate time creating engaging and entertaining content. It’s also extremely competitive, 93% of…

4 things every business owner needs to run a thriving business

Author: Ty Kiisel Small business owners come from different backgrounds and, many times, different skill sets. Regardless of whether your background is in sales, marketing, or a technical background, there are some things I’ve observed every small business owner needs to learn to successfully run a thriving business. Over the course of my 35+ years…

2021: The year of the compassionate consumer

The stress and uncertainty of 2020 has many of us re-examining our values as individuals and as consumers. The coronavirus outbreak has not only put a financial strain on most, but it has lead consumers of all incomes to consider their purchases more carefully. Consumers have become more empathetic and aware of the power of…