Author: Adam Aberback

The 3 Fastest Growing Small Business Industries

Across the country, there are a number of industries that are beginning to bustle with activity as more small businesses get in on the action. And if you’re looking for a tip on what these growing industries may be, then Inc. Magazine has you covered. The news outlet recently specified some of the fastest growing…

You Can Trust Small Businesses – And A Study has Proven It!

When you’re a small business owner, one of the most powerful tools in your arsenal is trust. Think about it: consumers have no idea who owns Wal-Mart, in fact, they probably don’t know a single person who works at their local branch of the brand. Yet, they do know the individuals who run their local…

3 Foolproof Ways to Show Lenders you’re a Low-Risk Borrower

Whether you’re looking at a traditional bank, or a nonbank lender like OnDeck, applying for a small business loan is all about illustrating your overall risk profile. A lender is looking to determine ways how likely you are to repay your loan – in full and on time. In order to make your application as…

The Friendliest States for Small Businesses

According to a recent study, some U.S. states are far more friendly and accommodating to small business owners than are others. The third annual Small Business Friendliness Survey, conducted by Thumbtack, aimed to determine the states and cities that offer regulatory standards and conditions that best accommodate small business owners. According to the small business…

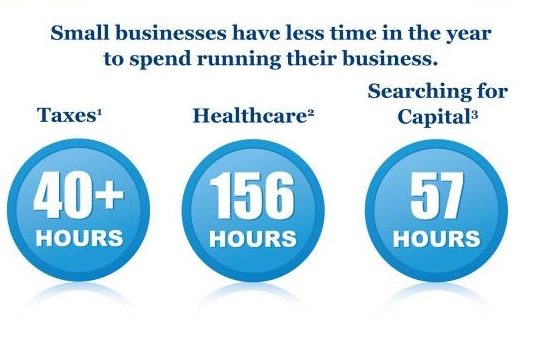

How Busy is Too Busy for Main Street?

Give Back to Employees with a Summer Get-Together

Getting your employees motivated can sometimes be a tough task. Sure, milestones will always spur the team forward – obtaining a high-level new customer, for example, or reaching a new sales goal. Yet most of the time, the hard work required by the job can be draining – especially in those sweltering summer months. That’s…

How to Meet the SBA’s loan criteria

To be eligible for a loan from a U.S. Small Business Administration-approved lender, you need to meet a lot of standardized criteria – all of them listed on the SBA’s website. However, you’ll need to do more than just meet the bare minimums, no matter what lender you’re applying to. Listed below are four tips…

Your Business and Personal Credit Scores are About to Mix

Many small business owners likely think that their business credit scores and their personal credit scores don’t have an effect on each other. That’s never been entirely true – and recent developments mean that business and personal credit scores are going to start impacting each other even more directly. According to a report from the…

The Coolest Small Businesses in America

We think every small business is “cool”, but the list below takes cool to a whole new level. – The Blue Starlite Mini Urban Drive-In, a miniature drive-in movie theater, located right in the middle of Miami, that allows space for a scant 18 cars per screening. – The Carousel Bar, which is exactly what…

OnDeck Generates $3.4B In Economic Impact & 22,000 Jobs Nationwide

We’re beyond excited to release our first economic impact report, which shows an estimated $3.4 billion in business activity and 22,000 jobs created from our $1 billion in small business loans delivered to date.

How many business credit cards is too many?

Business credit cards are commonly used as a source of small business financing. According to the U.S. Small Business Administration, 65% of small businesses use credit cards to fund their budgets, at least partially. There are many questions that all small business owners know they have to answer when they take out a credit card…

A guide to properly thanking your customers

As a small business owner, what keeps your customers coming back again and again? It isn’t simply having the best products and services. And it isn’t having the best promotions or marketing. Rather, creating an environment where your customers feel valued and appreciated is what fosters loyalty among your most important audience. 1. Don’t undervalue…

You know you’re a west coast business owner when….

It seems that West Coast business owners live in a different country than most others – one with year-round sunshine and organic products aplenty. If you want to see whether you could fit in that box – or if you’re a West Coast business owner yourself – then check out the maxims listed below. 1.…

What’s the difference between secured and unsecured loans?

As a small business owner, it’s important to understand the distinction between “secured” and “unsecured” when searching for financing. Secured business loans A secured business loans means that you need to offer collateral alongside your repayment. By offering collateral, business owners afford lenders a way of knowing that they can collect on the balance of…

How to stay healthy while managing your business

Running a small business isn’t a 9 to 5 job, and often times it’s easy to let your health fall by the wayside. However, if you continue to put the company first and your own health second, you’ll eventually burn out. Here are some tips to keep in mind that will keep you feeling healthy,…