Author: Adam Aberback

This Motivated Senator Wants to Fix the Small Business Loan Gender Gap

Recent studies have shown that woman business owners have a much tougher time obtaining small business financing than their male counterparts…and one motivated Senator is on the job and fighting for change. Maria Cantwell is the chairwoman of the Senate Committee on Small Business and Entrepreneurship, and she’s made closing this particular “gender gap” a…

Do You Classify Employees as Contractors? You May Need to Stop

Throughout the past decade, many small businesses have saved money by classifying their workers as independent contractors. They do so because an independent contractor – who, by definition, would have more rights to take work elsewhere than a standard employee – doesn’t need to be afforded the same healthcare, and other costs, that a full-time…

Dear Mr. President: Small Business Owners Have Something to Say

Small business owners are often referred to as community leaders – and it’s not just because their businesses serve as important pillars in their town or city. As one recent study from the National Small Business Association illustrates, entrepreneurs are an incredibly politically involved group. In fact, the stats seem to suggest that small business…

Are Millennials More Optimistic Business Owners?

Normally, you hear about “millennial” entrepreneurs creating startup tech companies like Facebook and Twitter. However, new data shows there are more “millennial” Main Street business owners than ever before, and younger small business owners may be even more optimistic – and more likely to hire – than their older counterparts. According to the Spark Business…

1 Essential Tip for Becoming a Better Borrower

We’ve often spoken about the factors that can help you and your business look more attractive to lenders – like having a strong business credit profile. While important, there’s one major factor lenders look at that requires greater attention: cash flow. James Good, of the Small Business Payments Company, explained to Forbes recently that small…

Why It’s Absolutely Okay to Start Planning for Retirement

With small business owners busier than ever before, planning for retirement can often get placed on the backburner. According to a recent article from the Wall Street Journal, many business owners think the eventual sale of their business can entirely fund their retirement. But, it can be especially difficult to place a future value on…

3 Essential Documents Your Business Needs at the Ready

One of the most important – albeit less thrilling – responsibilities business owners need to pay attention to is their paperwork. Although essential when it comes time to pay your taxes in the spring, having your key documents organized and ready is crucial for when you want to access financing. According to The U.S. Small…

3 Insanely Easy Ways to Improve Your Business Credit Score

We’ve detailed numerous ways business owners can boost their credit scores – including “5-3-2 Rule” and credit blunders to avoid. But what you’re looking for some easier fixes? Don’t fret – here are three easy ways to give your score a boost. But what you’re looking for some easier fixes? 1. Break your payments up…

Confidence among Small Business Owners Continues to Climb

No one would deny that it’s been tough for small business owners in recent years. However, if one recent report is any indication, times are getting easier – or, at least, small business owners are becoming more confident about their ability to weather the storm. The National Federation of Independent Business recently reported that its…

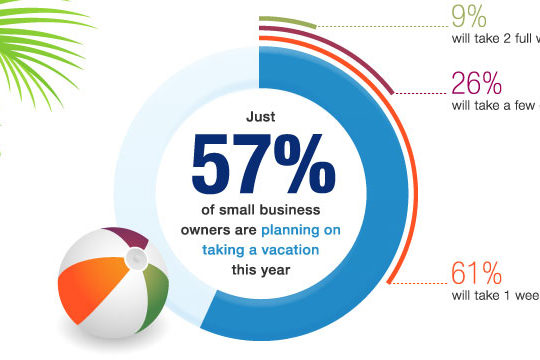

Running a Small Business Is No Vacation, OnDeck Study Finds

Today, OnDeck released the findings of its summer Main Street Pulse Report, a quarterly study of small business trends. The report examined vacation habits of small business owners nationwide, revealing that most are increasingly time-strapped and unable to take vacation. Based on responses from over 200 small business owners, we found out the following: Approximately…

The Only Gadgets Your Small Business Needs

We’ve put together a brand-agnostic selection of tools that can make life easier at any office. Better yet, all the tools listed below can be obtained for a low price (or in some cases, for free.) A USB Hub Think about all the things you have plugged into USB drives across the office: phones, tablets,…

5 Habits of Outrageously Successful Small Business Owners

Successful small businesses succeed on their own terms. The true legends stake out their own place – they don’t follow a well-worn path. However, that doesn’t mean that successful businesses don’t share a number of common traits. 1. Have a well-defined business plan and vision No business succeeds by copying others. And, your business can’t…

What the SBA’s New Guidelines Mean For Your Small Business

The U.S. Small Business Administration has changed the guidelines it uses to determine what a “small business” actually is. The new criteria now now allow an estimated 8,500 additional businesses to be eligible for the “small business” title, which comes along with certain federal assistances. According to a recent Wall Street Journal report, the criteria…

How the Gender Gap Affects Small Business Loan Approvals

If you’re looking to get a small business loan, there are many factors that come into play. Your credit history, your business’ cash flow and numerous other things will be looked at by lenders. However, there’s another factor that seems to be coming into play: gender. According to recent reports, female small business owners are…

Preparing for Taxes, Year Round

Every year in April, small business owners scramble to pay all the taxes that their business owes. This can sometimes be a stressful process: you’re scrambling in search of documents, digging through drawers in search of receipts, hiring accounting firms and much more to make sure you get every deduction owed to you. What if…