Articles

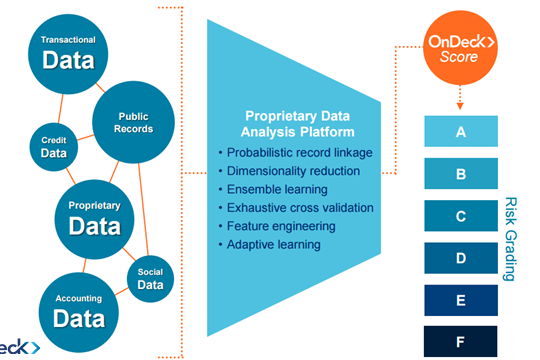

The OnDeck Score: Making Targeted Small Business Lending Decisions in Real Time

Since 2007, OnDeck has been transforming the way small businesses access capital, using our proprietary technology and small business credit scoring system, the OnDeck Score®, to efficiently evaluate a business’ creditworthiness and make targeted lending decisions in real time. So how do we actually do this? Keep reading to learn more about our OnDeck Score…

4 Important Questions to Ask Before You Apply for a Business Loan

There’s no question the notion that it takes money to make money isn’t lost on small business owners looking for capital to fuel growth or fund other business needs. And, for many business owners, a small business loan is where they find it. Although borrowing capital from traditional sources like the bank is still a…

6 Ways to Make Working with an Independent Contractor Successful

For certain tasks and projects at your business, it may make sense to find a contractor to get the job done. Follow these common-sense guidelines to get the most value out of the experience. 1. Use a Contract Every time you work with a contractor, use a written contract that both you (or a representative…

Young Wizards Academy Launches ‘Cauldron Creations’ Party

To celebrate our recent expansion into Canada, we held contests in Toronto and Vancouver to give small businesses the opportunity to win $5,000 (CAD) by answering one simple question: Why Do You Love Being a Small Business Owner? We’re checking in with Young Wizards Academy (YWA), our Vancouver-area small business winner 60 days after the…

Thanks, NASA: How Space Inventions Help Small Businesses

What does the recent exploration of Pluto have to do with your small business? Well, the research and development investment that the United States makes in the name of sending a spacecraft like New Horizons to discover that there’s flowing ice at the heart of the dwarf planet, that often trickles down to technology that…

Loan Stacking is Bad for Your Business

Have you heard of loan stacking? If you’re unfamiliar with the term, loan stacking is where a loan or cash advance is approved on top of a loan or advance that is already in place with similar characteristics and payback terms. While many business owners may have not heard of the term, there are a…

Is it Time for a Business Pivot?

Pivoting is a popular term for making a quick, often dramatic change from your original business focus. It’s often associated with venture capital-backed startups. But there are lots of ways to pivot, and your small business may be able to improve business or fend off a slump by learning how to be flexible, making small…

Business Credit Cards: Why Your Small Business Should Have One

If you’ve been using your personal credit card for business use, it’s time to take a look at how a business credit card can benefit your small business, and make your life easier. Don’t think of adding a business credit card as one more task on your list; think of it as opening up a…

ACH Payments and Small Business Loans

I vividly remember the last time I wrote a check. It was yesterday. What I can’t remember is the time before that. In fact, it had been so long that I had to search through my desk to even find a check. If you’re like me, and many others, you seldom use checks anymore. In…

Is Your Small Business Prepared for Disaster? How to Make Sure You’re Ready for Anything

Small business owners can control what they sell, whom they hire, and how they do business. Having the power to make decisions is one of the reasons many business owners like running the show, rather than working for someone else. All that still doesn’t give owners power over outside events. Natural disasters, financial crises, and…

Underdog’s Brewhouse Making a Case for Better Beer

To celebrate our recent Canadian expansion, we held contests in Toronto and Vancouver to give small businesses the opportunity to win $5,000 (CAD) by answering one simple question, Why Do You Love Being a Small Business Owner? Underdog’s Brewhouse, based in Oshawa, Ontario, is our Toronto-area small business winner. We’re checking in 60 days after…

3 Small Business Payroll Mistakes to Avoid

Handling payroll can be one of the most stress-inducing responsibilities of a small business owner. However, neglecting payroll–or doing a poor job of it–can bring your business down, and fast. Here are some of the most common payroll mistakes, and how you can overcome them. Mistake #1: Doing Payroll on the Fly As a small…

The Art and Science of Building a Successful Business: An Interview with Paul Butler

Building a successful business is the goal of every entrepreneur. Paul Butler, one of the authors of the book Think to Win: Unleashing the Power of Strategic Thinking, recently suggested that business success is really a combination of art, science, and the ability to think strategically. He and his co-authors, John Manfredi and Peter Klein,…

Should I Apply for a Business Credit Card, Line of Credit, or a Business Loan?

Deciding which type of credit is right for your business or your business purpose can sometimes be a challenge. And, in some cases there might be more than one way for a small business owner to access the credit he or she might need. A business credit card, a line of credit, and a small…

Does a Small Business Loan Make Sense for My Business?

Finding access to capital is a challenge for many business owners. It takes money to fuel growth—borrowed money for many small businesses. As online small business lending becomes more mainstream, and many business owners enjoy increased access, it becomes important to ask, “Does a business loan really make sense for my business?” I started working…