Articles

5 Ways To Turn Small Business Supporters into Bigger Sales this Holiday Season

The holidays are fast approaching. Black Friday is almost here, the day when millions of holiday shoppers will stand in line at 4am for deals on flat-screen televisions and the latest smartphone. It can seem intimidating for small businesses and local mom-and-pop shops to stand up to huge department chains with thousands to spend on…

Five Ways to Make the Most of the Holiday Shopping Season

The holidays are rapidly approaching, and as business owners know, that means holiday cheer—and the potential for increased revenues. Many retailers rake in a high proportion of their revenues during the holiday season. But how can you take an already good holiday cash flow to straight-up great? Have the right inventory. Make sure you’re following…

How to Use Financing for Your Medical Business

Like any small company, clinics and other medically oriented small businesses will encounter various times when funding is needed, to solve cash flow gaps or invest in equipment. Have you encountered any of the following scenarios in your business? Cash Flow Woes Keeping a positive cash flow is a challenge for most small business owners;…

Win $10,000 and a Meeting with Barbara Corcoran

Three lucky winners will each receive $10,000 and a one-on-one meeting with Shark Tank investor and real estate mogul Barbara Corcoran. Have you ever thought about what your small business would do with an extra $10,000—or a what it would be like to personally ask advice of one of the Sharks? To enter, tell us how you…

Want to Start a Franchise? Here’s What You Should Know.

Franchises are a tempting way to get into business ownership. Is this the right path for you? And if it is, how are you supposed to pick one out of the thousands of options? For those completely unfamiliar with the idea, franchises are businesses that trade their name and operating methods to people in exchange…

What is an Unsecured Small Business Loan?

An unsecured loan is a loan that requires no collateral and is based solely upon the creditworthiness of the borrower. In reality, very few unsecured true business loans exist today, especially those for larger loan amounts. While a bank may offer an unsecured consumer loan or line of credit to a particularly credit worthy borrower,…

When Should Small Businesses Decorate for the Holidays?

Walk into any department store, and it’s obvious: the holidays are upon us. The elaborate miniature winter villages, the glamorous plastic Christmas trees, and the reindeer sweaters seem decorate a solid chunk of the store, luring you into holiday splendor. Every year, the ornaments and tinsel seem to go up earlier and earlier. Instead of…

Will a Credit Check Hurt My Credit Score? It Depends

A good personal credit score can make a difference with some lenders when you apply for a small business loan. And while building a good personal credit score requires that you apply for and use credit, the associated credit check that follows every credit application can actually hurt your score. If this sounds confusing or…

How Two Marine Corps Veterans Teach Leadership to Corporate America

When Marine Corps captains Courtney Lynch and Angie Morgan left military service more than a decade ago for the private sector, they were surprised to find so few employees who understood the concept of leadership. There were leaders around, but “people were not recognizing that they were demonstrating leadership behavior,” explains Morgan. As a result…

Clues That Your State or City Is Welcoming to Small Businesses—and What to Do If It’s Not

When survey results declare certain states or cities welcoming to small business, owners in those regions pat themselves on the back. And rightly so. Scoring high in metrics such as ease of hiring, starting up, or following regulations means that a region is keen to make successful entrepreneurship possible. Your job, as a small business…

Business Isn’t Personal—Nor Should It Be

For many reasons (particularly in regard to credit), business and personal don’t mix. Although many entrepreneurs capitalize their early-stage startups with personal funds—they might use their home equity, personal savings, or personal credit cards to get things off the ground— it may not be a good idea for the long haul. Here are just a…

How to Start a Veteran-Owned Business

Founding new business is a process that anyone with skills, ideas, a budget, and staying power can decide to do. Fortunately, for military veterans, the process of starting a business will seem quite natural, since your military training and service gives you advantages many entrepreneurs lack. In fact, veterans display more innate entrepreneurial traits than…

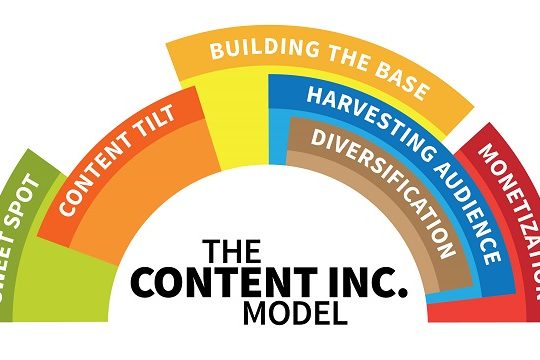

Content Marketing: An Interview with Industry Guru Joe Pulizzi

I met Joe Pulizzi shortly after he published his first book, Get Content Get Customers. The company I was with did a two-day workshop with him to develop a content strategy in 2009. This was in the very beginning of what would become a content marketing revolution and eventually lead to the creation of the…

Improving a Good Credit Score to Make it Great

There’s no question, in many situations a business owner’s personal credit score has an impact on his or her ability to get a small business loan. While your personal credit score is not the best proxy of the health of your business and is only one of many factors we consider to evaluate your business’…

Facebook Page vs. Website: Which Should You Use?

A strong digital presence is key to success in our tech-oriented society. Maintaining a website, however, requires time and money that small business owners don’t always have in great supply. If you’re looking for ways to simplify your online efforts, Facebook’s recent updates might seem pretty appealing. But are they good enough to stand in…