We all know getting a small business loan can be tricky given the current state of the economy and lending standards, but it looks like Main Street isn’t alone.

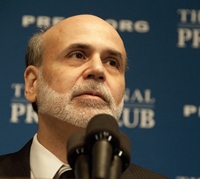

One doesn’t have to look any farther than former Federal Reserve Chairman Ben Bernanke to see the impact of more stringent regulation. The former Fed leader revealed at a recent conference that he had encountered problems refinancing his home loan.

Even with laughter from the crowd, Bernanke stressed that he really did have difficulty with refinancing.

He told moderator Mark Zandi of Moody’s Analytics that mortgage credit conditions may have shifted too far in one direction.

“The housing area is one area where regulation has not yet got it right,” Bernanke said at the conference, according to Bloomberg. “I think the tightness of mortgage credit, lending is still probably excessive.”

You may be asking yourself: How did this happen to a person like Ben Bernanke? A recent report from the Mortgage Bankers Association found that mortgage credit availability was the same in September as it was in August. The organization’s Mortgage Credit Availability Index had a reading of 116.1, where the benchmark is 100 and higher numbers represent looser standards.

Also, Bernanke just switched jobs – and that can cause many lenders to take a closer look at his application.

Do you think banks are being too hard on Bernanke? Weigh in below.